The preliminary estimate of real gross domestic product (GDP) growth for the fourth quarter of 2019 on the surface shows a continuation of solid continuation of the economic expansion, but the underlying data contains several areas of concern. GDP rose by an annual rate of 2.1 percent in the fourth quarter of 2019, according to “advance” GDP estimate released by the Bureau of Economic Analysis on Thursday, which was in line with expectations. In the third quarter, real GDP increased 2.1 percent.

The good news

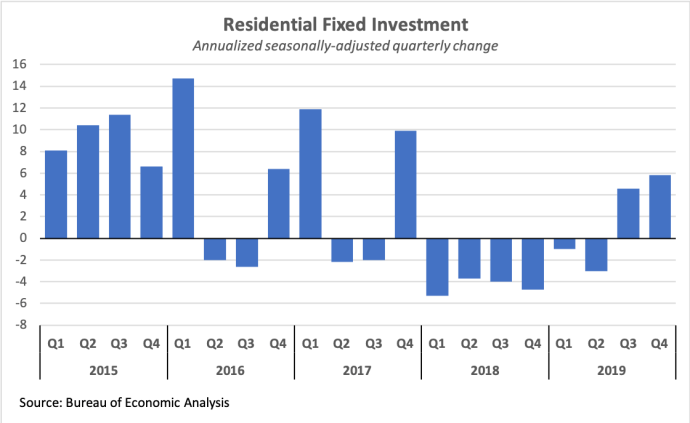

On the positive side, residential fixed investment continued its strong rebound from the third quarter, rising by 5.8 percent. The probably was due to a combination of a shortage in housing inventory and support from the Federal Reserve’s interest rate cuts. An 8.7 percent drop in imports, largely due to international trade tensions, helped to boost the net exports (exports minus imports) component of GDP growth.

The bad news

On the negative side, non-residential fixed investment fell for the third straight quarter in row, dropping by 1.5 percent. This category of spending will need to return to positive growth soon for the economy to continue to grow at more than 2 percent.

Mixed indicators

Although personal consumption spending growth remained relatively strong at 1.8 percent, it has weakened in the last two quarters. Results from the next two quarters should show if this the result of consumers taking a breath from the more rapid increases of the second and third quarters or the beginning of a longer trend of consumption growth below 2 percent.

I would also place the 3.6 percent increase in federal consumption and investment spending in the mixed category. Over the short term, this spending rise does give a boost the GDP growth. Over the long term, however, government spending cannot continue to rise faster the supporting economy without squeezing out private-sector investment and consumption.

Looking forward

Residential construction is likely to remain strong until the current shortage in the housing inventory is reduced, which should support economic growth over the next several quarters. The declining non-residential investment remains worrisome and could drag the economy into more sluggish growth if it is not reversed soon. It is unclear which side of the trade ledger, imports or exports, will gain the most from the recent easing of trade tensions with China. The impact of the Wuhan coronavirus on US-Chinese trade and global economy is also a wild card at this point.