The Commerce Department’s release of its “second” estimate of gross domestic product (GDP) growth for the second quarter of 2022 on Thursday confirmed the the US economy has fallen into a recession. Although the revised number showed that the economy shrunk by only 0.6 percent at an annualized rather than by 0.9 percent as reported in the “advance” estimate, the underlying data shows that troublesome headwinds going forward that are more likely to prevent a quick recovery and instead cause the recession to deepen. the Real GDP decreased 1.6 percent in the first quarter.

Strong growth in exports of goods and services was the primary support for the economy in the second quarter, but this is likely to weaken as continued international tensions from Russia’s invasion of Ukraine and China’s slowdown tamper foreign demand of US goods and services. The growing prospects for energy shortages in Europe this winter as Russia retaliates for NATO’s support for Ukraine is particularly worrisome.

The modest 1.5 percent growth in consumer spending, also known as personal consumption, during the second quarter is likely further slow or turn negative in the second half of the year as inflation continues to outpace wage growth.

As the following graph shows, real disposable income has been declining since the middle of last year. As a result, households have been able to support modest growth in consumption only by tapping into their savings. Without a prospect for a turnaround in disposable income growth, households are likely to start pulling back their consumption in the second half of the year.

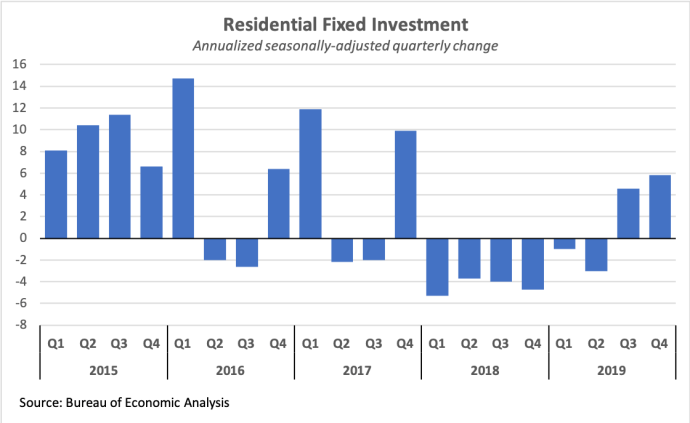

This is already being seen by the pullback in the housing market. New home construction, also known as residential fixed investment, fell by 16.2 percent in the second quarter. Further increases in home mortgage rates in the second half of the year driven by the Fed’s policy to continue to raise interest rates to bring down the highest inflation in a generation will prevent any recovery in the housing market this year.

Finally, rapidly rising interest rates are also causing businesses to pull back their investment spending. Further interest rate increases by the Fed will lead businesses to reassess their long-term investment plans that were based on the continued availability of low borrowing costs.